st louis county sales tax pool cities

Louis County Sales Tax is collected by the merchant on all qualifying sales made. This sales tax is levied under the authority provided to the county by Section 67547 RSMo.

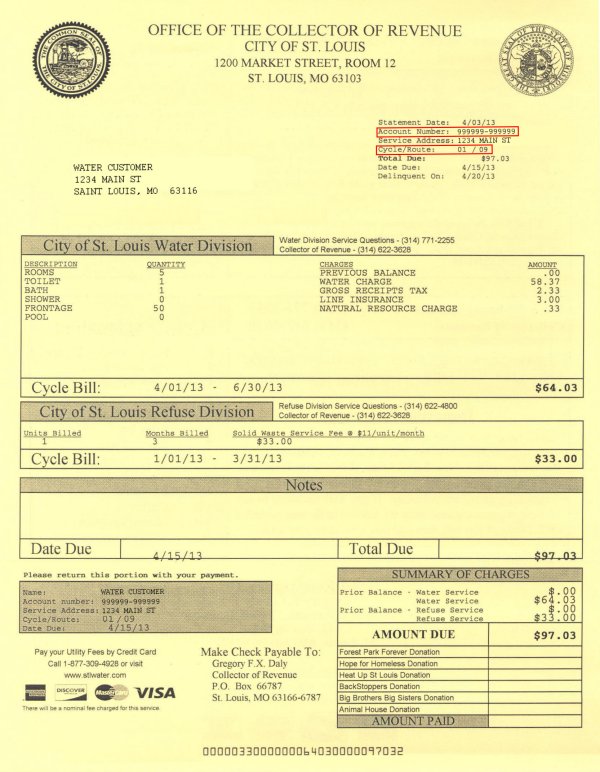

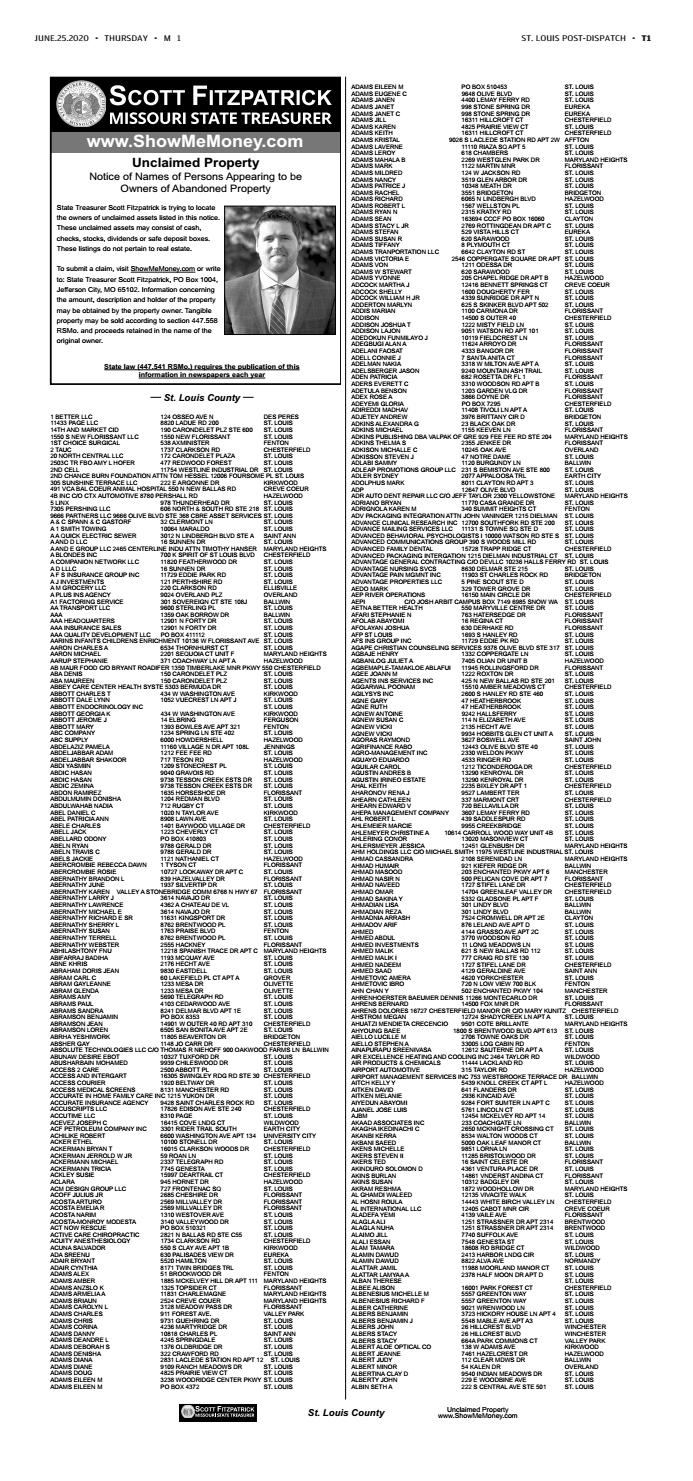

2014 St Louis County Unclaimed Property By Stltoday Com Issuu

They keep most of the sales taxes collected within their boundaries but submit a portion to the pool.

. They should take this opportunity to expand the pool system to include all. Louis County voters approved the sales tax on April 4 2017. Those who support the pool system should do more than fight for the status quo.

Pool cities by. Ad Lookup Sales Tax Rates For Free. Louis County appears to be near.

April 5 2022 and April 12 2022. The pool also includes the countys unincorporated areas. In 1993 the Legislature required point-of-sale cities to divert some of their money from the tax to the pool.

Members get daily listing updates. The Missouri state sales tax rate is currently 423. This is the total of state and county sales tax rates.

The 1 sales tax generated in each pool city goes into a collective pool and is then. Louis County 58ths 625 to cities towns and villages and. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899.

A pooled sales tax system helps remove government from the real estate development industry but adding new point-of-sale cities would cement the governments involvement even further. The City of Chesterfield receives a share of the county-wide 1 tax on retail sales through a pool comprised of unincorporated St. Wayfair Inc affect Missouri.

The final action in what has been a long heated battle over the distribution of taxes in St. Did South Dakota v. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes.

Tour the newest homes with pools make offers with the help of local Redfin real estate agents. Louis County is put into the pool which then goes into the countys coffers. Dave Schatz R- Dist.

May 10 2022 and May 17 2022. Steve Birmingham Neighbor. Find houses with pools spas and community pools for sale in St.

The minimum combined 2022 sales tax rate for Saint Louis Missouri is. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. 38ths 375 to St.

The Saint Louis sales tax rate is. JEFFERSON CITY Certain cities in St. Under the law each municipality and unincorporated St.

Chesterfield was required to be a pool city when it incorporated in 1988. Always consult your local government tax offices for the latest official city county and state tax rates. Sales Dates for 2022 Sale 208.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Log In Sign Up. ALL PROPERTIES HAVE BEEN SOLD.

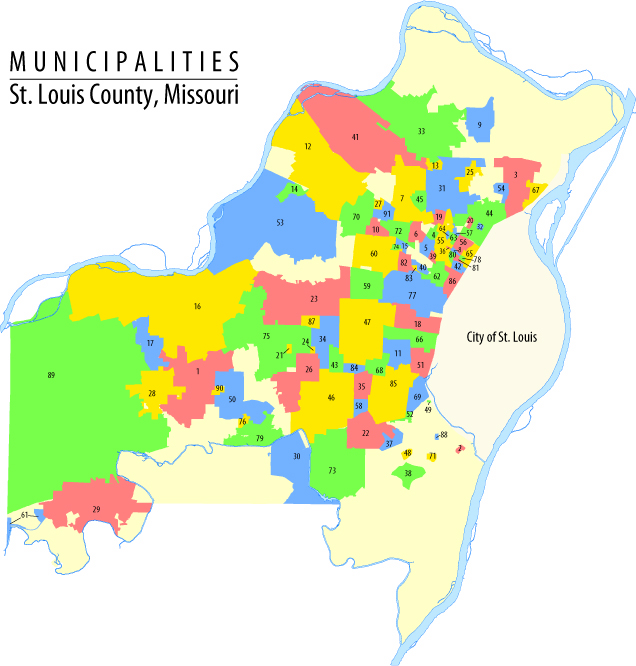

Louis County cities which were incorporated after March 19 1984 or areas annexed after March 19 1984 are automatically included in the. This is the total of state county and city sales tax rates. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

The latest sales tax rate for Saint Louis County MO. Louis County will get to keep more of the sales tax revenue they generate under a bill signed Friday by Gov. More detail on the change 21 years ago.

On May 11 and 12 respectively the Missouri Senate and House of Representatives approved legislation sponsored by Sen. Missouri has a 4225 sales tax and St Louis County collects an. Louis County cities a bigger share of the sales tax revenue collected within.

The St Louis County sales tax rate is 226. This table shows the total sales tax rates for all cities and towns in St. Revenue received from this sales tax shall be distributed as follows.

April 19 2022 Published Dates. Louis County cities a bigger share of the sales tax revenue collected within. Louis County were given authority for a capital improvements sales tax.

Interactive Tax Map Unlimited Use. Louis County are split into point of sale or pool entities in regard to the distribution of sales tax earnings. The 2018 United States Supreme Court decision in.

The City of Crestwood later challenged this exemption in court and won the right to put the tax on the ballot. Louis County and most other Missouri counties except the City of St Louis once annually a tax certificate sale will be held in the 3rd week of August. Most point-of-sale cities such as Des Peres have major shopping centers.

26 to open up the St. This rate includes any state county city and local sales taxes. Thats because any sales tax thats generated in unincorporated St.

Louis County were given authority for a capital improvements sales tax. Louis County and many of the cities throughout St. The pool also includes the countys unincorporated areas.

Of the countys 90 municipalities 57 are pool cities. NO LAND TAX SALE MAY 26 2022. JEFFERSON CITY The Missouri Legislature on Thursday approved giving Chesterfield and some other retail-rich St.

Louis County cities have differing views on tax sharing pool and whether the current system is fair or necessary. 2020 rates included for use while preparing your income tax deduction. There are 1st year tax sales meaning the taxes are 3 years delinquent 2nd year tax sales meaning the taxes are 4 years delinquent and no one bid on or confirmed the 1st year tax sale.

The Missouri sales tax rate is currently. BALLWIN MO KTVI During Monday nights Ballwin alderman meeting officials voted and passed bill 38-71 for attorney John Hessel to. Louis County is put into the pool which then goes into the countys coffers.

Other cities soon followed Crestwoods lead. The county and Chesterfield are numbered among the pool entities. 12 Cent Capital Improvements Sales Tax In 1987 all Missouri cities except those in St.

Help us make this site better by reporting. The County sales tax rate is. Land Tax sales this year are held 5 times a year in April May June July and August.

Louis County sales tax rate is 3388 which is made up of a transportation sales tax 05 a mass transit sales tax for Metrolink 025 an additional mass transit sales tax 05 a Regional Parks and Trails sales tax 0288 a childrens trust fund sales tax 025 an emergency. The state sales tax rate is 4225. Louis County sales tax allocation and allow some cities to keep more of the.

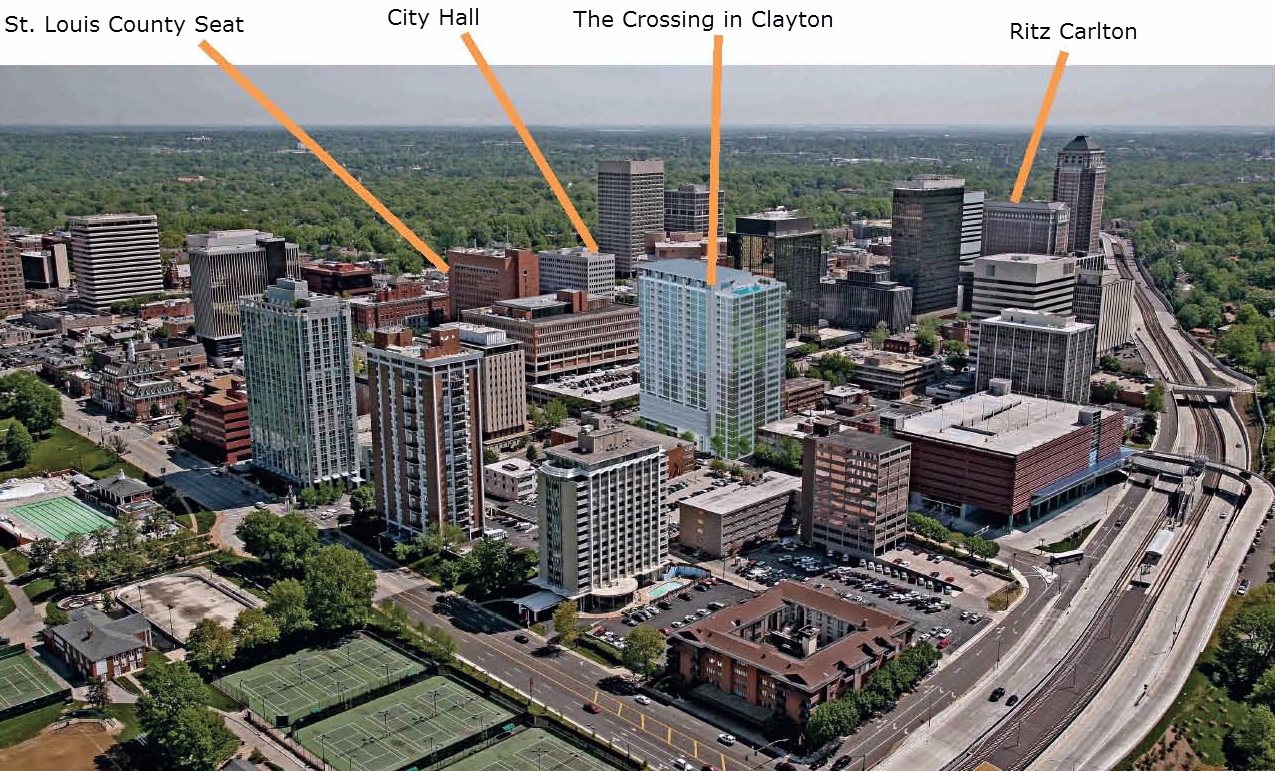

72m Twenty Four Story The Crossing In Clayton Receives Tax Abatement Nextstl

The 10 Best Saint Louis Convention Hotels Jun 2022 With Prices Tripadvisor

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 127 And Get 33 Off

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 127 And Get 33 Off

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

2020 Unclaimed Property St Louis County By Stltoday Com Issuu

Which Are The Most Dangerous Places In Saint Louis Quora

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

2022 Best Places To Live In St Louis County Mo Niche

Stl Area Misconceptions Treaty

Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com