multistate tax commission allocation and apportionment regulations

Application of the apportionment and allocation provisions of Article IV of the Multistate Tax Compact. Adopted February 21 1973.

Proposed Amendments Would Change Apportionment Rules

In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General.

. USA February 28 2017. 2 a and Commission Bylaw 7 c this is to notify you that. Multistate Tax Commission Allocation and Apportionment Regulations as adopted February 21 1973 and revised through July 29 2010To help determine whether a group of affiliated.

1 See Resolution Adopting Amendments to the Multistate Tax Commissions Model General Allocation and Apportionment Regulations Special Meeting of the MTC February 24 2017 a. Multistate Tax Commission Model General Allocation and Apportionment Regulations Current as of 2017 2 PREFATORY NOTES These prefatory notes and the drafters notes below are. These Regulations are intended to set forth rules concerning the.

Automotive Oil Sales Fee. 2 City plan commission. Pursuant to the Multistate Tax Compact Art.

As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of. All rules listed link to the Texas Administrative Code on the Secretary of States website. To participate by telephone dial 1-719-457-1414 access code 258090.

Amusement Machine Regulation and Tax. 2 Applicability and Scope of Rule. The Texas Comptroller of Public Accounts recently released guidance explaining the application of Texas sales and use tax to online sales.

A developer shall not be required to waive the right of appeal as a condition for approval of a development project. Under submetered billing the owner uses submeters at each dwelling unit to bill tenants for water and sewer services based on their actual water usage. In particular online buyers must pay.

In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment. The amendments to the model. This rule is intended as an interpretive guideline in the application of Article VI of the Multistate Tax Compact section 32200 RSMo implemented by.

A developer may appeal the directors. On February 24 2017 the Multistate Tax Commission adopted amendments to its Model General Allocation and Apportionment Regulations. Allocation and Apportionment Regulations.

Under allocated billing the owner.

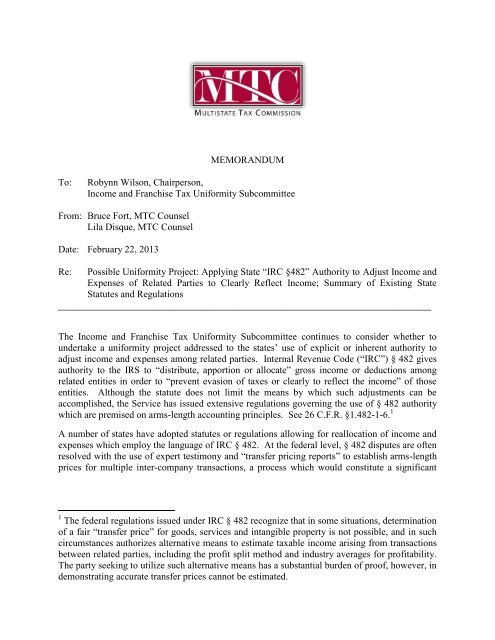

Memorandum To Multistate Tax Commission

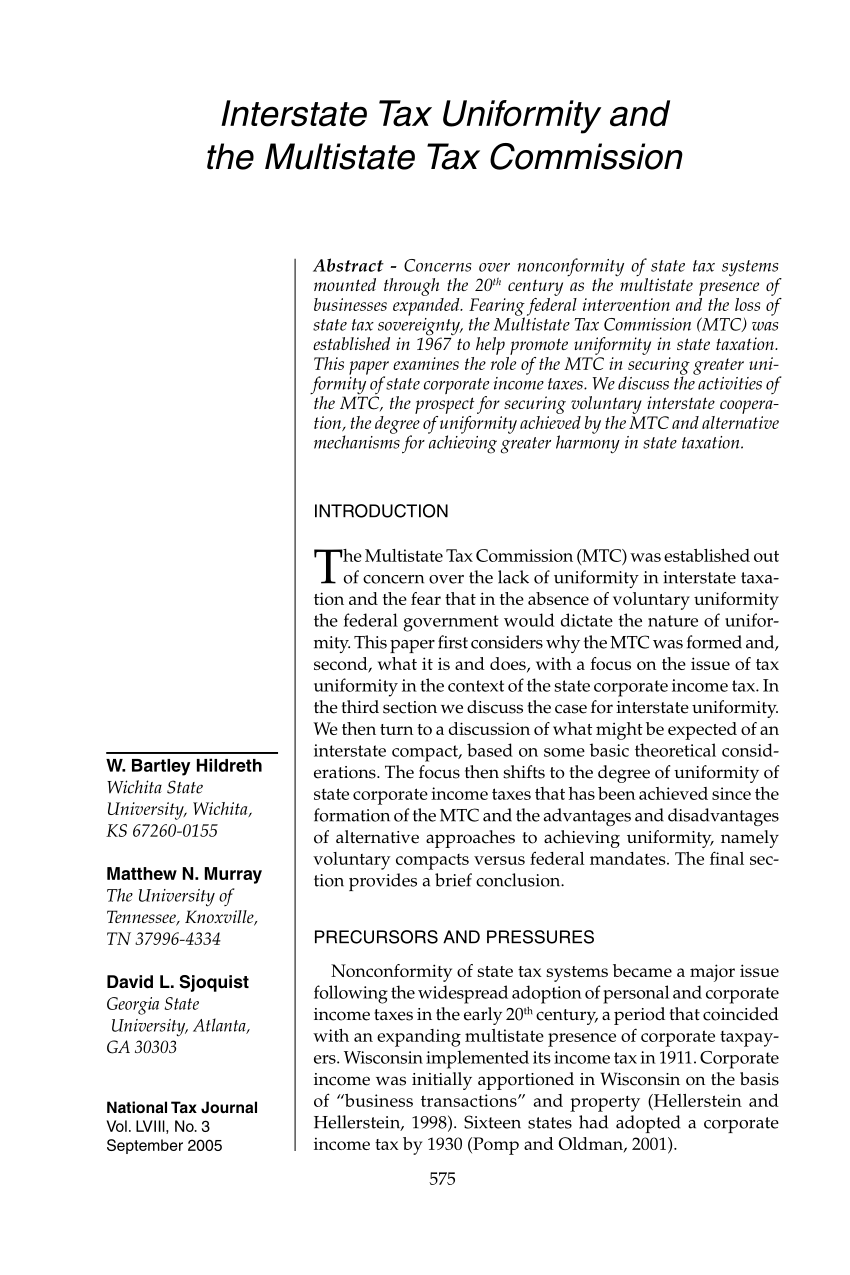

Pdf Interstate Tax Uniformity And The Multistate Tax Commission

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Usa State Local Tax Top Stories Of 2015

Memorandum To Multistate Tax Commission

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Apportionment Using Market Based Sourcing Rules A State By State Review

Eversheds Sutherland On Twitter Multistate Tax Commission Mtc Adopts Allocation And Apportionment Regulations Https T Co S0v1teel1x Tax Statetax Https T Co Vzxupukx4p Twitter

Unfair Apportionment Consider The Alternatives Tax Executive

Multistate Tax Compact Ballotpedia

Multistate Tax Commission Home

Vermont Clarifies Corporate Income Tax Apportionment Rules

Draft Workgroup Memo Multistate Tax Commission

Memorandum To Multistate Tax Commission

Draft Workgroup Memo Multistate Tax Commission

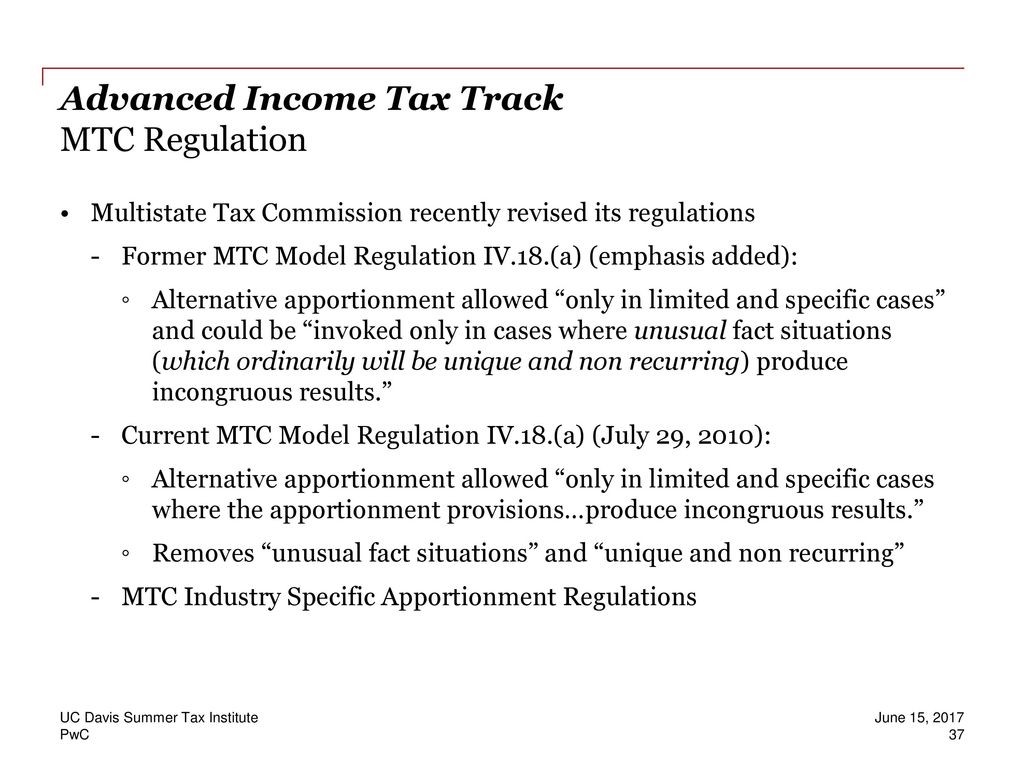

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Podcast Apportionment Sourcing What You Need To Know Pkf Mueller

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download